Personalized Planning for All Employees

Our lives are more complicated than they have ever been. We realize this and that is why we help our participants look at all their spending considerations beyond their retirement plan. Our advisors provide one-on-on financial planning to all the participants of the 401k plans we manage. We are able to provide these services because we conduct all our meetings over the phone and via the internet, keeping costs to a minimum, so we can pass on the SERVICE to our clients!

Retirement Planning

“As you can see from this side-by-side comparison, there are a number of changes we need to consider to improve your plan and get you into your Confidence Zone.”

College Calculator

“These days, it’s said that the only thing more expensive than a college education is not having one – the difference in lifetime earnings between someone with a four-year degree and a high school diploma is over $800,000! But college is expensive, and costs are increasing faster than general inflation. I have a very useful college calculator that can help you get a sense of average costs, or we can look up a specific school and estimate what it will cost when your child is 18. I can even rank schools in each state by cost if you want to look at other options. Most importantly, we can look at different ways you can offset the full cost and get a sense of what you should be saving now to ensure you can help your child attend.”

Social Security Maximization

“Have you given any thought to when you’ll begin taking income from Social Security? Here you can see the impact of taking income from Social Security earlier and later, and you can decide which strategy makes the most sense for you.”

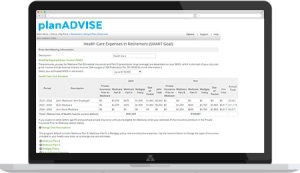

Health Care Planning

“I know you’ve stated that health care costs are a big concern for you and your spouse – I hear that from many of my clients. As we develop your financial goal plan, it will be important that we use realistic health care expenses so that you can be confident in your plan’s results. Fortunately, I have access to information from reliable database sources that will provide us a good estimate upon which to plan for this critical goal.”

Personal Financial Management Apps

Our financial software is available to every participant of every plan. It allows for a close-up look at our participants’ balances from all their financial companies, including banks and credit card companies. We also enable our participants to link their outside investment accounts to ensure they are looking at all their investments in one place.

Expense Analysis

The Expense Analysis app enables investors to categorize and track expenses in real time.

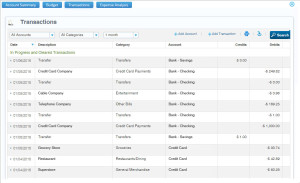

Transactions

The Transactions app gives investors a 360 degree view into activity across all accounts in one convenient location.

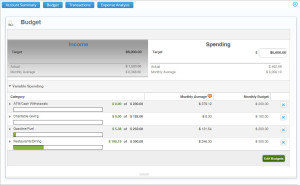

Budget

The Budget app helps investors set specific budgets for each goal or category to easily monitor their monthly cash flows and expenditures.